1) What does re-pricing of medical insurance products mean?

It is a revision of the premium payable for your medical insurance policy.

2) Why does my medical policy require re-pricing?

There are many factors which impacts repricing. Some common factors are as provided below:

i. Change in Claims Frequency – An increase in the number of people who make a claim compared to what is expected.

ii. Change in Claims Severity – An increase in medical expenses due to:

- higher demand for healthcare services.

- increasing costs of medical treatment, drugs & diagnostic tests due to inflation.

- rapid advances in medical technology.

- an ageing population.

- an increase in non-communicable diseases (e.g., chronic illnesses).

- currency depreciation resulting in an increase in cost of imported medical devices & equipment and medication.

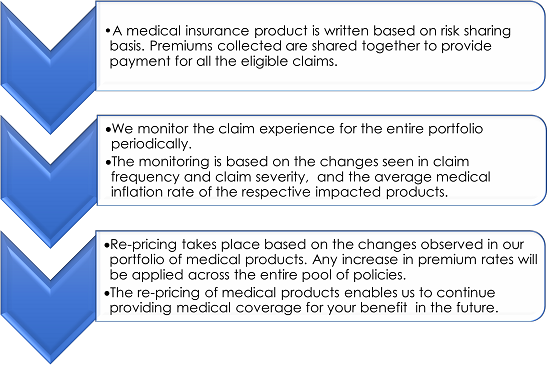

3) How does re-pricing take place?

4) How does re-pricing impact you?

If adjustments to premium rates are necessary and your policy is impacted, we will inform you at least 30 calendar days before effecting the revision to the premium rates. We will also advise you on the options available to you.

5) What should you do?

i. Please read though the notification on premium adjustments carefully, understand the options and take appropriate action.

ii. We strongly advise you to consider the options recommended to avoid losing your medical coverage. You have the option to cancel or not renew your policy.

iii. It is important to note that if you choose to discontinue or terminate your existing policy, you will lose your medical insurance coverage. Also, obtaining a new cover could result in a revision of the timeframe applicable to when your pre-existing condition exclusion starts, and medical tests may be required to review your current health condition.

Disclaimer: Please take note that the above information is for general information only. Some of the information may not be applicable to you. Please speak to your servicing agent or call us at 1 800 88 8811 / 603 2118 0188 (9.00 a.m. to 5.00 p.m., Monday to Friday), or email AIGMYCare@aig.com.